LexID® for Insurance Building a Clearer Vision for Pricing and Customer Data Management

LexID® and our Scalable Automated Linking Technology (SALT) have existed as a powerful linking ingredient behind the scenes, ever since we launched in the UK and Ireland around a decade ago. But in the coming months our clients are going to be hearing a lot more about how we’re developing LexID®, to enhance the process of customer data management, bringing a lot more of the disparate customer data that exists, for better pricing, marketing and compliance, in fact across the whole insurance continuum. To learn more about the linking technology and SALT behind LexID®, you can read more in an earlier blog article.

LexID® and our Scalable Automated Linking Technology (SALT) have existed as a powerful linking ingredient behind the scenes, ever since we launched in the UK and Ireland around a decade ago. But in the coming months our clients are going to be hearing a lot more about how we’re developing LexID®, to enhance the process of customer data management, bringing a lot more of the disparate customer data that exists, for better pricing, marketing and compliance, in fact across the whole insurance continuum. To learn more about the linking technology and SALT behind LexID®, you can read more in an earlier blog article.

So just a reminder about our product portfolio and our product vision, our goal is to do three main things. The first part is to continue building upon our own proprietary data assets and insights and provide those on an ongoing basis. Some examples would be Risk Insights, Policy Insights and Quote Intelligence for example. The second part is the product platforms we’re building to enable those products to be delivered in an efficient way. And the third part of this is the third party data and the way this can be enriched with our in-house data, helping to support customer data management.

In this way we can start to address the issue of creating a more 360-degree view of the insured, their lifestyle triggers and risk requirements, which is a big market challenge.

What are the things that insurance providers are having trouble with? What are the tools they need to serve customers better, to price better, with more appropriate products, and to engage better? The constant response we hear to this question is that it’s really all about customer data management, and this is where LexID® for Insurance comes in.

As we know there is a lot of consumer data and device data in this world and it’s ever-growing. These are exactly the same issues for insurance as any other service business. So if we take just the policy-related data, the insurance provider has got marketing database data, or claims information coming in all the time. They’ve got applications or quote data. This comes in many different types and it relates to different vertical markets, often in different data silos or sitting with subsidiaries or intermediaries, whether it is for a motor product, home, small commercial, life insurance or pet insurance even. They’ve got a lot of data and it’s flowing in fast, getting bigger and bigger. The insurer has obligations to look after the information, to keep it secure, and undertake maintenance and data audit. But to get value out of that data and to use if effectively is in fact really difficult.

Records quickly get out of date; they quickly become incorrect; they can become inconsistent. Even for the largest insurance companies with their own inhouse analytics and technology resources, the legacy databases from historic M&A activity create an additional layer of challenge around integration and data standardisation. For them, data often resides in many different silos, it’s structured or unstructured data. It can be really difficult to manage.

With these types of data challenges come disconnected customer relationships, duplicate accounts, duplicate records, and a high cost associated with managing data storage in different places.

Essentially here we’re talking about waste and activities being duplicated across the industry, which could be better handled in one place. In terms of the customer relationship – thinking about renewals or being able to recommend personalised coverage for an individual – often we’re talking about giving customers mixed messages or sometimes the wrong message.

Do you know how many customers you have?

Do you know precisely how many customers you have, as distinct from how many policies? More than likely you will not be able to recognise them all – across insurance brands or lines of business – when you’ve got the same customer on multiple different insurance products. This represents missed opportunities to cross-sell, missed opportunities to communicate in a more informed manner, and to fulfil the principles of Treating Customers Fairly.

With this can also come difficulties in terms of compliance and data audit. How do you find and declare the data you have on a customer if you can’t easily find it and you can’t link it together?

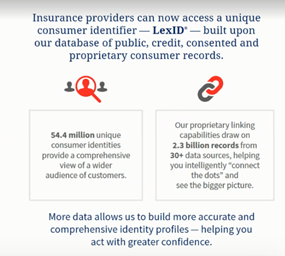

So what is LexID® for Insurance and how can it help? As mentioned we have built the LexID® database and we’ve been using it for some time internally, as a huge data asset. It comprises approximately 2.3 billion records from many different data sources. And this is raw consumer information from many different sources. So our starting point is this very large, comprehensive database and that’s very important of course. But even more important is how to compress those 2.3 billion records into something comprehensive and something manageable that an insurance process can consume? Essentially, we use our technology and our processes to slim down that data into a single person as much as possible.

We hold around 54.4 million unique consumer identities at the current time, that we’ve been able to crunch down from those 2.3 billion data points. These are what are known as core LexIDs and obviously the figure is getting very close to the total number of UK adults in the country.

So the data verification and matching process is really about how do we compress all that raw data into one person, one single LexID®?

Consider for a minute, we may have 20 different raw strands of data within those 2.3 billion records. And that explains about a person, about any changes of name, about all the places they’ve lived over the last ten years. This can be different addresses, linking them all of them together to bring it back to a person and attach that to their insurance history.

LexID® for Insurance linking billions of customer records

LexID® can actually bring all those disparate data strands together and that’s the real value. Because if an incoming quote comes in, and there are different addresses that could relate to that individual, any of those addresses can be verified and linked at point-of-quote. We can link that prospect to the correct information via LexisNexis Policy Insights or NCD, or any database that touches the individual ID. It could also be within our client’s database or private Hosted Data linked to our infrastructure. It’s about linking all that together with our client’s data.

So there may be five different quotes delivered for example, but now it’s becoming possible to link them together under a record for a single person and single date for the quote activity.

I also want to say more about what LexID® for Insurance can actually do. All of this means that if you can bring data together from quote silos, from policy history databases, from compliance databases, from marketing databases, you can actually offer a more personalised experience, a better customer experience and improved targeting. It means reducing waste and reducing cost: getting better insights to understand the lifetime value of a customer. There are also applications for managing and streaming claims more effectively, with greater precision, and also helping to identify possible fraud signals where they exist in other databases. There are many different applications in which linking all this data together can be really valuable.

To take an example of a typical client, we’re essentially able to bring in new links across the whole of their customer data management processes.

Let’s assume the challenge consists of over one million records of current insurance customers and historic data, adding up to about 100 million data points, including quote data from different sources, maybe different brands. Typically what we see is a ‘spaghetti’ of different data standards and different data repositories that frankly is very hard for an insurer to use.

The goal for us with this client is to bring in the data spaghetti and link it together to enable the creation of specific pricing models and decision models that they can then apply in real time to each quote that goes out. And we’ll post those pricing flags for them and apply a LexID® in the output at point-of-quote.

So essentially, it’s a pricing benefit for the client. But it’s also about bringing together all that disparate data, to create accurate pricing models that they can apply anytime someone quotes across any brand, or any line of business within the group.

Solving data linking for better customer data management

The strength of the LexID® that we’ve been building over the past ten years has potential to be a powerful strategic lever for insurance providers. It deals with data maintenance challenges in a holistic way, as well as for an immediate pricing benefit. We’re going to be using our tried and tested resources and batch delivery to service the LexID®, built from header data. That’s the 2.3 billion data points I mentioned at the start.

We are bringing all this together at point of quote through our Data Hub, with all our broad data linking assets within LexisNexis Risk Solutions. It’s for for insurance-specific data, industry-wide policy history data as well as financial history data, which is a dimension no single insurer could build, nor would they practically speaking seek to build it this way.

We expect to be helping more clients use LexID® for Insurance in their quoting processes as well as for ongoing data maintenance. To fulfil the full potential it can become part of the operational network for our clients, and not just in quotes and policy data but also in the data lying behind that: the marketing data, BI data and claims data as well.

The LexID® can be applied to any individual wherever they touch an insurer’s systems. It can become part of the natural language of the relationship with the insured, creating closer relationships and new opportunities for engagement, crossing different lines of business.

Follow the link to the LexisNexis Risk Solutions website to find out more about how we support insurance providers.