Seamlessly automate financial crime management

With unified onboarding, ongoing screening and transaction monitoring, banks, challengers and credit lenders gain market advantage by deploying our cloud platform.

Seamlessly automate financial crime management

Simplify Customer Onboarding.

Monitor Transactions.

Reduce Risk and Financial Crime.

Financial crime is growing. Every customer must be verified, every transaction monitored and risk-scored. Only digital solutions can offer the near real-time insight, analysis and actionable data needed. And only the LexisNexis® RiskNarrative® Platform brings powerful automation under your total control.

Discover a unified, future-ready orchestration platform: quick to setup, easy to configure, zero coding required. RiskNarrative is a comprehensive solution used to verify, transact with, and monitor your customers, clients, and suppliers.

Seamless Customer Journeys

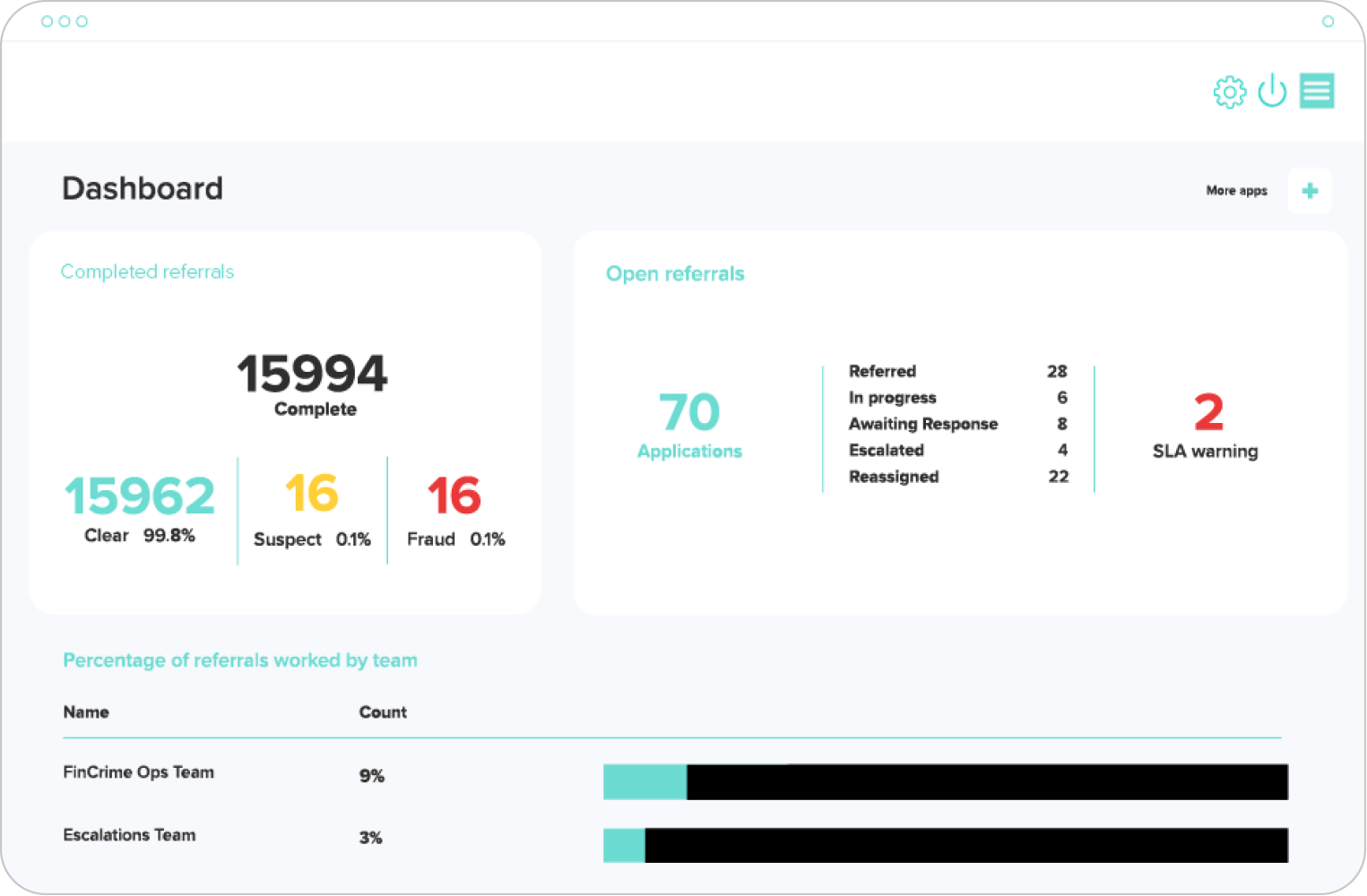

The RiskNarrative Platform delivers end-to-end Financial Crime Management: full digital onboarding, frictionless transactions, and complete compliance.

Unified Orchestration

Via a single API, a suite of micro-services drives decisioning, case management, workflow and orchestration through an AI powered solution.

Agile Compliance

The RiskNarrative restful API is easy for the tech team to integrate. Using a no-code drag and drop strategy builder, your fraud and compliance teams can create bespoke customer journeys and react instantly to fraud trends, risk, market and regulatory changes.

Testimonials

Digital, automated orchestration for:

ID Verification

Verify and Authenticate across 200+ jurisdictions in near real time. Utilise data, biometrics, liveness check and real-time processing to orchestrate a smooth ID journey.

Application Fraud Prevention

Access the perfect balance between traditional methods of detection and the latest techniques.

eKYC

Enjoy a smooth workflow combined with robust data services and efficient case management to help you tackle KYC challenges head on.

Transaction Monitoring

Continuously monitor customer transactions by combining multiple rules, data, machine learning and human intuition to identify fraud and prevent money laundering.

AML Monitoring

A flexible rules engine, machine learning and efficient case management system lie at the heart of the RiskNarrative solution for AML Monitoring. Ensure your compliance whilst keeping costs low and transactions smooth.

Behavioural Monitoring

Make commerce safe. Spot good customers faster whilst flagging criminals more easily. Behavioural monitoring from RiskNarrative lets you understand high-value customer behaviour patterns and differentiate their experience.

Book a Demo

Transform the way you control compliance and financial crime in your business.

Register now to see the LexisNexis® RiskNarrative® Platform in action.