Press Room

77% of Commercial Property Insurance Providers Stuck with Manual Underwriting/Pricing Processes

- Only 23% of commercial property insurance providers say their underwriting/pricing policies are all or mostly digitised

- Claims is the area least likely to be digitised, with 62% of providers saying this process is all or mostly manual

- Market is split on pace of digitisation – only 55% think it has become more prevalent over the past year or two

- 77% of insurance providers are using data enrichment or plan to soon

25/02/2020

LONDON — A study of the commercial property insurance market by LexisNexis Risk Solutionsi detailed in a new White Paper ‘A Digital Divide?’ concludes that close to half of commercial property insurance providers risk losing market share if they fail to adopt digital transformation and in turn a greater level of automation across their businesses.

In the study, just 23% of providers confirmed their underwriting and pricing processes are all or mostly digitised whilst 49% said they are all or mostly manual, leaving 28% using a mix between the two. Applications have seen the biggest digital transformation with 42% of insurance providers stating this is all or mostly digital. However, claims remain almost totally reliant on human skills - only 17% of providers say claims processes are all or mostly digitised.

The findings contrast with growing levels of automation spanning our daily lives, creating a potential mismatch in what the market currently delivers versus what their commercial customer expects from their insurance provider.

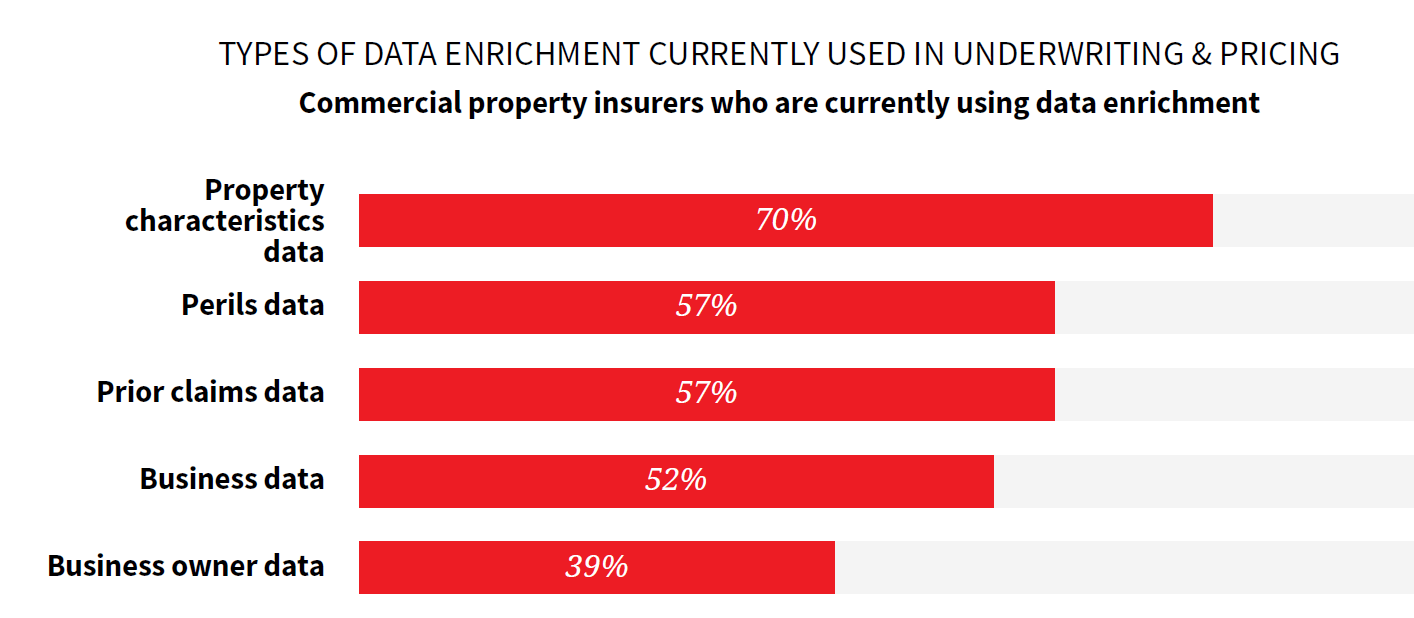

While opinion is split over the pace of digital transformation, with 55% of those surveyed agreeing that digitisation in pricing and underwriting has become more prevalent in the past two years, the sector recognizes the significance of data enrichment to gain a more holistic view of the risk. 77% of insurance providers are using data enrichment or plan to soon. Unsurprisingly perils data on flood, fire and subsidence risk has the highest value to the market. This is followed by insights on prior claims related to the property and the policyholder, with 57% of insurance providers using claims data, and 69% of those rating this as extremely or very valuable.

Jonathan Guard, director, commercial insurance, LexisNexis Risk Solutions, UK and Ireland, said: “The balance between human skills and efficiency gains through automation is one that many insurance providers are looking to find but you can’t have automation without digitisation so this really does need to be the priority right now. It’s almost certain that the providers who are slowest in adopting digitisation will become increasingly vulnerable to the loss of sales and market share.

”The good news is that the market sees the value of data enrichment to create a more holistic view of risk with property characteristics the most used dataset. The use of and on-going appetite for claims data is evident and underlines the need for an industry-wide contributory database of prior claims data to benefit the entire market. Such a database could also provide additional data points including under-utilised director and business data, which can provide invaluable insights on the state and history of a business and its owners. This would help put the commercial property market in the best position possible when it comes to understanding and mitigating their exposure to risk.”

LexisNexis® Risk Solutions harnesses the power of data, sophisticated analytics platforms and technology solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit LexisNexis Risk Solutions and RELX.

i LexisNexis Risk Solutions has published a white paper, ‘A digital divide?’, sharing the results of the latest study, which involved more than 100 insurance professionals working in relevant lines of insurance.

Media Contacts

Sr. Director, Communications

Insurance and Connected Car and Coplogic Solutions

[email protected]

+1.678.896.1463