Digital Divide Infographic: Differing Insurance Opinions on Data Enrichment

Over the last four years at LexisNexis Risk Solutions we’ve been regularly polling commercial property insurers about attitudes to data enrichment, identifying pain points in the sector and opportunities to invest in the right types of databases, ultimately to better serve policyholders and property owners.

Over the last four years at LexisNexis Risk Solutions we’ve been regularly polling commercial property insurers about attitudes to data enrichment, identifying pain points in the sector and opportunities to invest in the right types of databases, ultimately to better serve policyholders and property owners.

Some of the recurring themes – pricing pressures, the need for a cheaper route of access to data, and better infrastructure to serve the e-trade segment, uncertainty and the specific challenges for brokers – were reinforced in our survey of 101 commercial insurers* earlier this year.

As in all lines of insurance business, commercial property insurers collect a wealth of data on customers in the application, even excluding additional external information such as company and directors information, business sector information, local crime, fire or other perils information. Our research continues to show that relatively few are succeeding in fully leveraging this data opportunity. There is awareness of ‘data as a business model’ and data use as a competitive differentiator for pricing and easier, faster processes. This has never been more important, but attitudes are mixed when it comes to thinking about it as an immediate or future opportunity.

The COVID-19 pandemic has served to remind us about the importance of protection and that long-accepted assumptions about risk can be quickly challenged.

Data insight is key to dealing with the new challenges such as business interruption, business solvency, risk, empty properties, changes in the mix of office usage, changes in weather, perils risks, and other factors.

Data is also the key to preparing for those rare or ‘black swan’ type events such as a health crisis, climate crisis, economic crisis or weather surge events. In some ways the COVID-19 pandemic has brought commercial insurance more to the forefront, with the need to redesign products, to rebuild a relationship with policyholders, with better use of real-time monitoring, better data visualisation of risk, and better advice about risk in general as it applies to a particular business profile.

Our latest survey results signal there is an understanding of the value that digitisation, and data enrichment can bring. There is an awareness that particularly in the large SME sector (SMEs account for 99.9% of the UK business population, 5.9 million businesses representing 52% of all business turnover) there is a need to bring in some of the data-driven processes for fast and sharp pricing and underwriting that exists in the motor segment.

Automation, efficiency and customer engagement opportunities leveraging data enrichment

More commercial insurers are using data analytics to shift their role by providing brokers with the tools to integrate data-driven decision making into areas such as cross-selling and reducing customer churn. These analytics tools spotlight the highest-value clients and high-potential leads so brokers can invest resources more efficiently, predict customer churn more accurately to help improve retention, and generate benchmarking to identify additional sales opportunities.

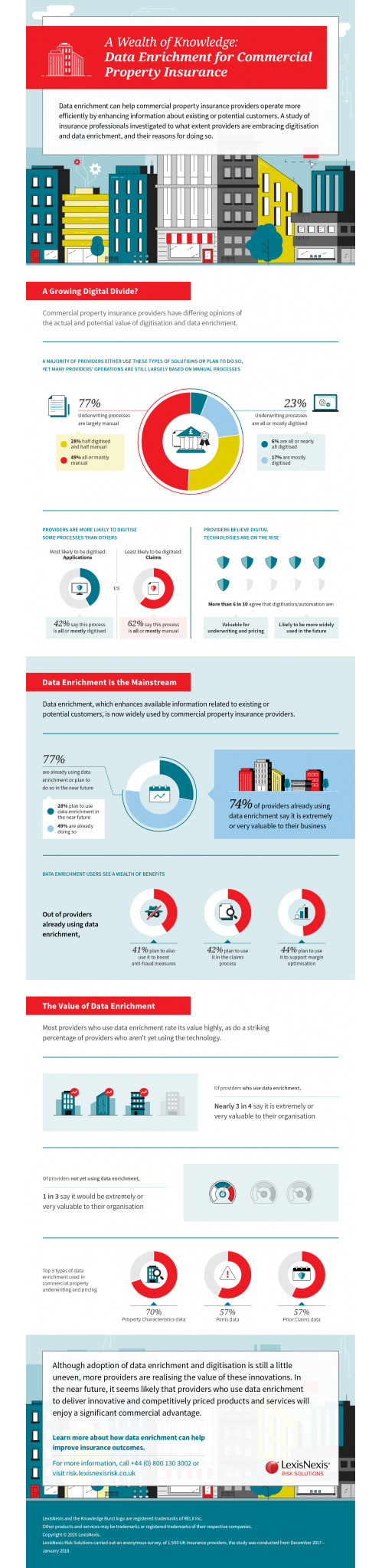

So data enrichment is spreading within this segment of insurance. But also the adoption is uneven – for reasons of legacy technology and attitudes – and there is some scepticism about the value of data enrichment, when we asked insurance providers that don’t yet significantly apply data enrichment. Here are some examples of this duality of opinion:

- 74% of commercial property insurance providers that are already using data enrichment said it is ‘extremely valuable’ or ‘very valuable’ to their business.

- 49% of commercial property insurance providers are already using data enrichment. A further 28% said they plan to do so in the near future

- But, only 23% said their underwriting processes are ‘all digitised’ or ‘mostly digitised’, including just 6% who said these processes are ‘all digitised’ or ‘nearly all digitised’

- And only 64% ‘somewhat agreed’ or ‘completely agreed’ that digitisation or automation will be used more widely within the insurance industry in future

- In our survey it is the application stage that commercial insurance providers said is the process most likely to have been digitised. Claims is the least digitised process and 62% said their claims functions remain ‘wholly manual’ or ‘mostly manual’.

- There were differences in attitudes and adoption of data enrichment depending on whether an insurance provider served its commercial property business in its personal lines division or commercial lines division.

More highlights are shown in the infographic.

For more insights from these research results download the LexisNexis Risk Solutions commercial insurance white paper ‘A Digital Divide?’

*LexisNexis Risk Solutions was not identified as the sponsor of this research, which was based on a mixture of telephone and online surveys of 101 insurance professionals working in relevant lines of insurance, and was first published in February 2020.

Follow the link to the LexisNexis Risk Solutions website to find out more about how we support insurers.