How Merchants can Manage Risk in a Rapidly Growing Market

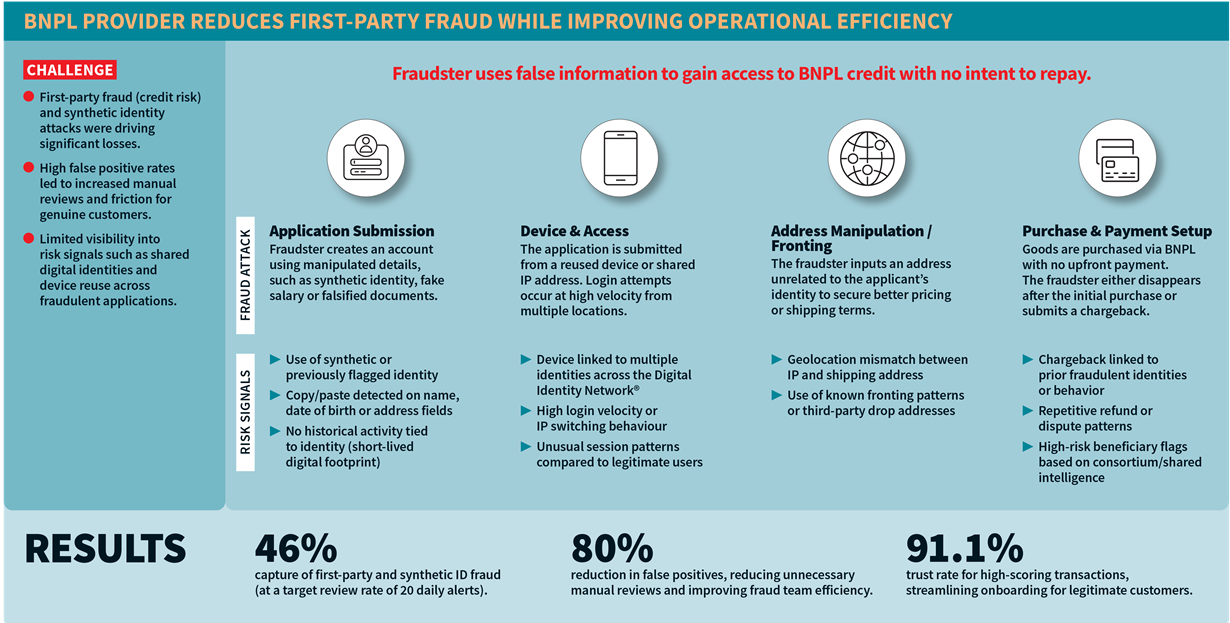

As this payment model becomes increasingly embedded in digital commerce, particularly among younger consumers, merchants and lenders must remain vigilant. Fraud risks are not only growing but also diversifying in nature. From first-party misuse to synthetic identity creation and bot-driven attacks, BNPL fraud is rapidly evolving in both sophistication and scale.

Why BNPL is Ripe for Exploitation?

BNPL services are attractive for their speed and ease of access. Customers can often access funds with minimal onboarding, and transactions typically bypass traditional credit checks, features that support user convenience and merchant conversion rates. However, these same characteristics contribute to elevated fraud exposure:

- Low barriers to entry: Many BNPL providers implement only basic eligibility checks, making it easier for bad actors to slip through.

- Minimal identity verification: Weak identity verification practices create opportunities for synthetic and third-party fraud.

- Deferred repayment structures: The time lag between purchase and repayment provides fraudsters with a critical window to act undetected.

- High-value goods: Fraud attempts often target premium items, increasing financial losses when attacks succeed.

- Rapid approvals: Automation and speed, while beneficial for user experience can amplify fraud risk without adequate safeguards.

Emerging Fraud Patterns

BNPL fraud extends beyond conventional boundaries. In addition to account takeover and synthetic identity use, providers are contending with the rise of “fraud-as-a-service” models. These schemes proliferate via social platforms, equipping would-be fraudsters with detailed playbooks on how to exploit BNPL systems.

We are also seeing an increase in:

- First-party fraud, such as users with no intention to repay or those filing false chargebacks.

- Bot attacks, orchestrated to submit high volumes of applications across multiple merchant sites.

- Synthetic identity fraud, where fraudsters blend stolen and fictitious data to create seemingly legitimate identities.

Have Sales Contact Me

Products You May Be Interested In

-

BehavioSec®

Uncover user intent from login to logout with real-time behavioural and device intelligence

Learn More -

IDVerse®

Powered by proprietary AI, IDVerse delivers fully automated authentication of identities in seconds

Learn More -

Emailage®

Emailage® is a proven risk scoring solution to verify consumer identities and protect against fraud

Learn More -

ThreatMetrix®

World-leading digital identity intelligence and embedded AI models through one risk decision engine

Learn More