Extensive risk data backed by global experts

Gain a clearer risk outlook with politically exposed person (PEP) list, sanctions and adverse media screening

Supported by a worldwide network of over 450 research experts and analysts, WorldCompliance™ Data delivers customised access to 6 million global risk profiles covering individuals, organisations, businesses and vessels from across 240 countries and territories. The expansive risk database includes one of the most comprehensive and up-to-date politically exposed persons lists, aggregated information from over 100 global sanctions lists, details of enforcements sourced from over 1,600 government websites and an extensive proprietary database of adverse media profiles compiled from over 30,000 news sources.

Utilising consolidated watchlist and risk data allows organisations to:

Expedite PEP and sanction checks

Synchronise and simplify AML compliance processes

Streamline customer acquisition

Mitigate the impact of global volatility

Politically Exposed Person List

Ensuring an organisation’s compliance with all applicable laws and regulations through the process of PEP screening can be a complex task.

An accurate PEP list is an essential part of the risk-based approach, helping to identify politically exposed customers and prospects. WorldCompliance™ Data provides an expansive, market leading PEP list of over 2.5 million PEP profiles and is continually updated by a global team of over 450 researchers to ensure data is as accurate and complete as possible.

Information is also provided on state owned entities (SOEs) – government owned companies or organisations whose senior management or directors will often include public and government officials (PEPs).

The status of PEPs can change overnight, therefore it is vital to carry out PEP checks on an ongoing basis to mitigate risk. Our team of skilled researchers are strategically placed around the world to monitor any changes and react quickly to update PEP list records, with over 88,000 profiles created or updated every month on average.

A PEP search with WorldCompliance™ Data can provide the following level of detail:

Personally Identifiable Information

Relationships

Transparent Substantiation

Sanctions and Enforcement Lists

Sanctions checks are an absolute requirement for many organisations. WorldCompliance™ Data contains over 123,000 sanction profiles compiled from over 100 sanction lists.

WorldCompliance™ Data also includes enforcement information sourced from global enforcement lists and court filings taken from bodies such as the UK Financial Conduct Authority (FCA) and US Securities and Exchange Commission (SEC). Information is sourced from over 1,600 official government websites including industry regulators, law enforcement agencies, central banks and other government offices. The information covers disqualified directors, penalised brokers, unauthorised banks and most-wanted lists from police forces around the world.

WorldCompliance™ Data is available via multiple delivery methods, to suit all business types and sizes. With options for automated screening of millions of transactions per day, to low volume manual sanction checks.

Sanctions lists and watchlists covered include:

| HM Treasury Sanctions List | Office of Foreign Assets Control (OFAC) Sanctions | Bureau of Industry and Security |

| Department of State | EU Consolidated Sanctions List | FBI Top Ten Most Wanted |

| Interpol Most Wanted | ICE List (U.S. Immigrations and Customs Enforcement) | CBI List (The Central Bureau of Investigation) |

| SDN & Blocked Entities | SECO List | Treasury PML List |

| UN Consolidated Sanctions List | OCC Shell Bank List | World Bank Debarred Parties List |

Sanctions Screening:

A Best Practice Guide

Adverse Information Checks

When entering a business relationship with an individual or organisation, their exposure in adverse media can pose a reputational and regulatory risk. Every day negative news or unfavourable information about individuals or businesses is reported across thousands of news channels around the world in multiple languages.

Adverse media screening is a critical part of any robust enhanced due diligence (EDD) program. Screening at the onboarding phase and continuing to re-screen all those identified as high-risk is crucial in order to identify accounts that may need to be declined services or monitored closely for usual transaction activity.

WorldCompliance™ Data monitors information compiled from monitoring over 30,000 news sources to create profiles on individuals and companies linked to a wide range of illicit activity such as financial crime, terrorism and human trafficking. WorldCompliance™ Data includes 50 adverse media subcategories including money laundering, drug trafficking and organised crime.

Request access today and discover how countless negative news stories are consolidated into single adverse information profiles, streamlining the adverse media search process.

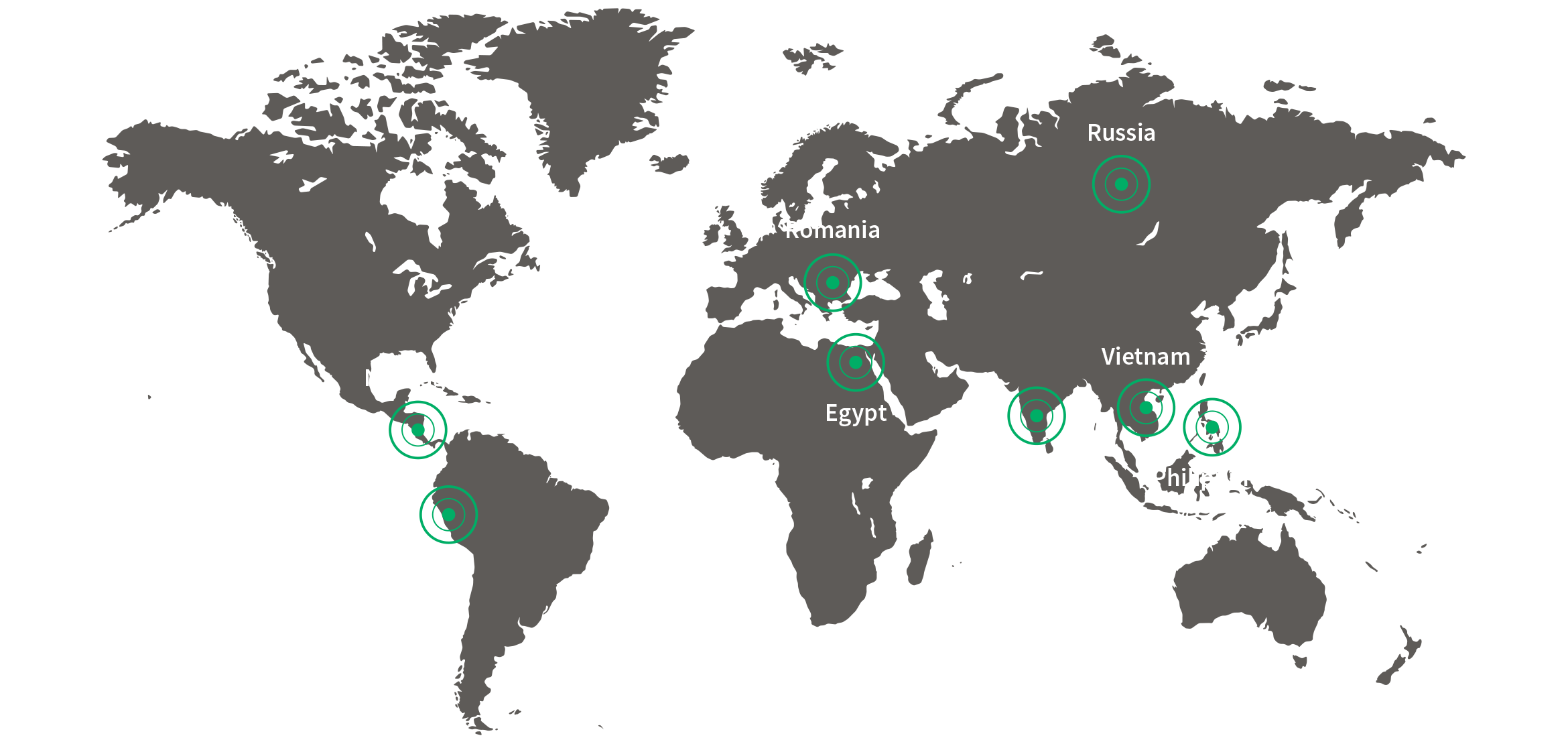

Unmatched Network of Global Research Experts

24 hour awareness of global risk events is provided through a team of more than 450 expert researchers and automated monitoring systems. Researchers are strategically placed across 5 continents and fluent in 58 languages, to help ensure risks are captured, regardless of location and language.

The rigorous investigative process provides a comprehensive and segmented database of high-risk individuals and entities. WorldCompliance™ Data is updated daily with, on average 200,000 additions or updates per month, monitoring thousands of world-wide channels to identify potentially relevant news articles or alerts which cover adverse media changes, PEP changes, enforcement actions and sanctions updates.

Step 1: Data Compilation

Automated systems and researchers mine media channels, news websites and public records across the world to compile data on politically exposed persons and individuals or organisations linked to high-risk activities.Step 2: Data Validation

Results are analysed and validated to produce a detailed profile of an individual or business entity.Step 3: Profile Summary

Each profile contains unique identifiers and a complete relationship web, identifying and linking related entities, family members and close associates.Step 4: Data Updates

Profiles are continuously monitored for any changes in circumstances of the subject or related entities, with thousands of updates made every day.Step 5: Customisable Data Segments

Profile contents are compiled into a series of database segments and risk categories, which can be tailored and utilised according to an organisation’s risk appetite.WorldCompliance™ Data Access Methods

Web-Based Interfaces

Due Diligence Screening:

Bridger Insight® XG

Enhanced Due Diligence:

LexisNexis Risk Management Solutions® – Global

Identity Verification:

IDU®

Flat-File Data

Data files can be provided offline in XML and text delimited format to integrate with your screening system.

API

A search API is offered via our screening platform, Bridger Insight® XG for seamless integration.

Orchestration: Smooth, Seamless Customer Lifecycle Management

Screen against extensive PEP, sanctions and adverse media data

Book a demo to find out more.

Products you may be interested in

-

RiskNarrative®

Orchestration platform providing a highly sophisticated, configurable and accessible financial crime lifecycle management solution.

Learn More -

Compliance Lens

Transform the way you conduct AML screening. Benefit from industry-leading data and state-of-the-art matching and filtering technology.

Learn More -

Bridger Insight® XG

Powerful screening and ongoing monitoring platform for financial crime compliance

Learn More -

LexisNexis Risk Management Solutions® – Global

Enhanced due diligence platform combining consumer, business and risk data into a single platform. Conduct robust enhanced due diligence checks quickly

Learn More -

IDU®

Identity management platform for verifying and authenticating an individual’s identity

Learn More