Balance strong fraud protection and streamlined customer experiences– with IDU®, you can achieve both.

We offer a highly comprehensive view of the UK adult population, giving you the power to drive operational efficiencies and the confidence to trust your customers are who they say they are.

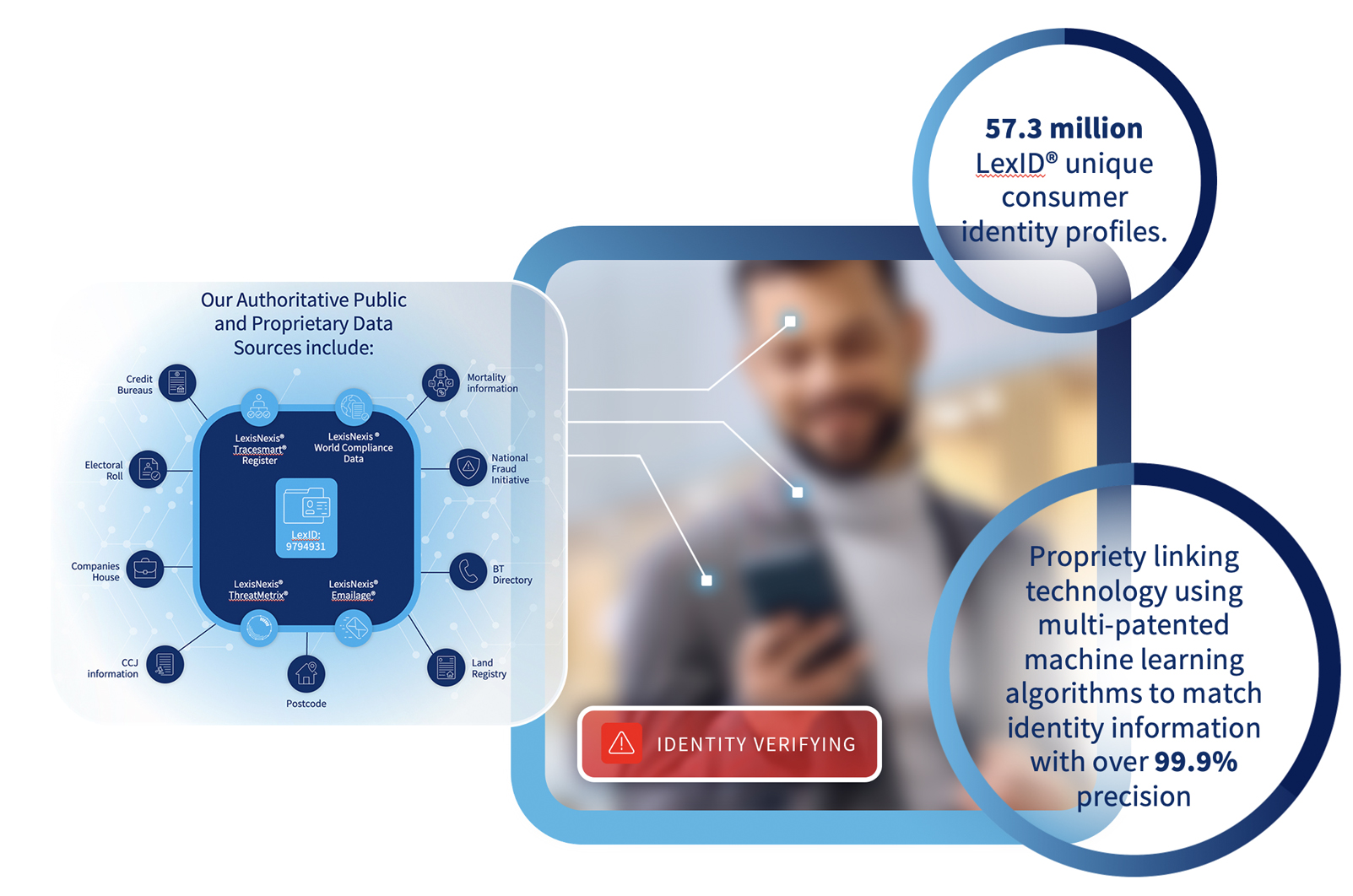

LexisNexis® IDU® leverages over 2.85 billion UK consumer data points and 20+ years of referential data to accurately verify identity.

Our proprietary, multi-patented linking technology connects and corroborates disparate data to create one of the most comprehensive identity databases in the UK, spanning 57.3 million unique LexID® consumer profiles.

IDU® enables fast, seamless onboarding journeys and identity verification checks to support customer acquisition and accelerate customer conversion.

Instantly verify the identity of genuine customers

Support compliance and due diligence checks

Build an assured identity with strong customer authentication

Maintain a full and paperless regulatory audit trail

How this can affect your organisation

LOSS OF BUSINESS

as customers abandon account applications or transactions due to delayed response times particularly during peak traffic.

INCREASED COSTS

to meet compliance requirements and maintain separate identity verification and fraud prevention solutions.

GREATER RISK EXPOSURE

and financial loss from increasingly sophisticated fraud attacks.

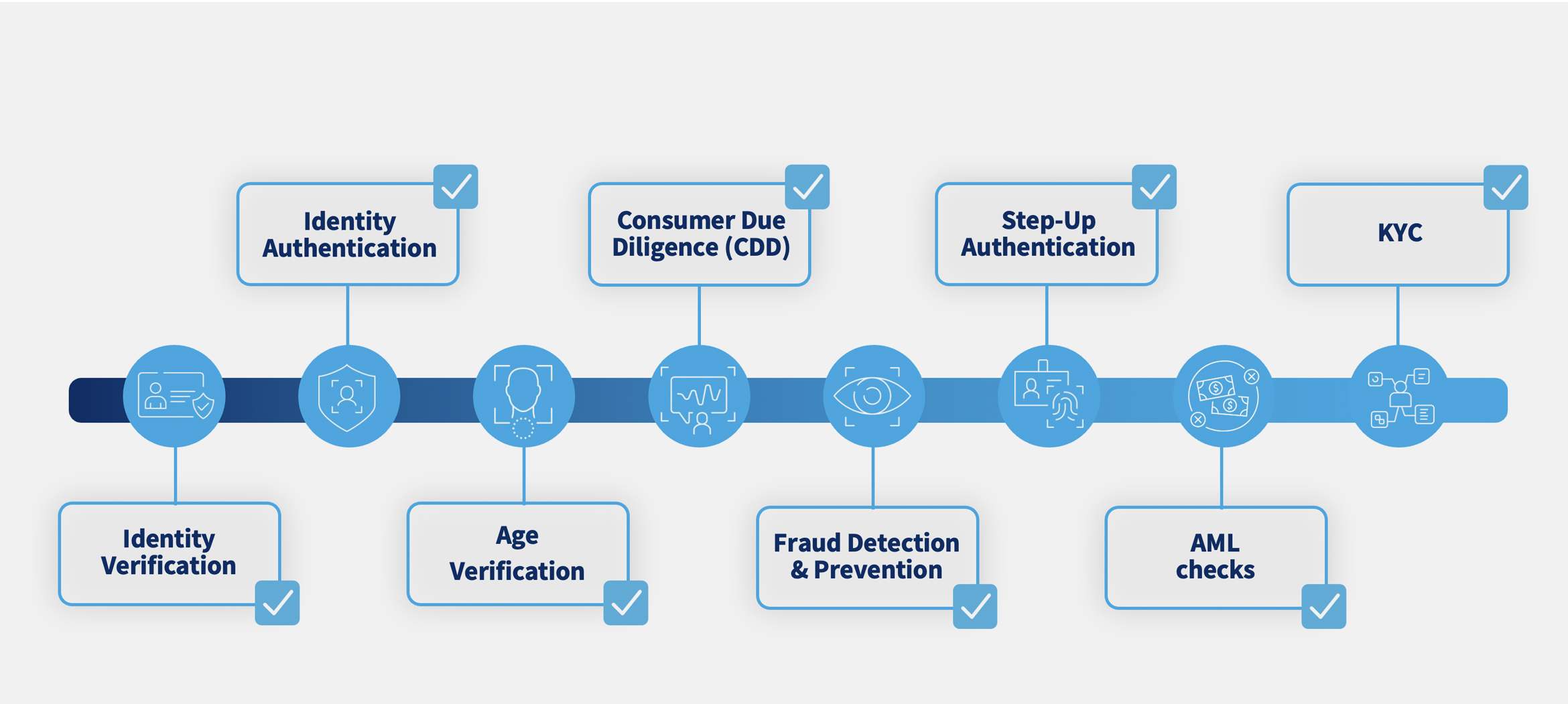

Configure IDU to support specific IDV use cases

IDU offers options to meet a range of IDV requirements:

PII Verification

Additional Data Sources

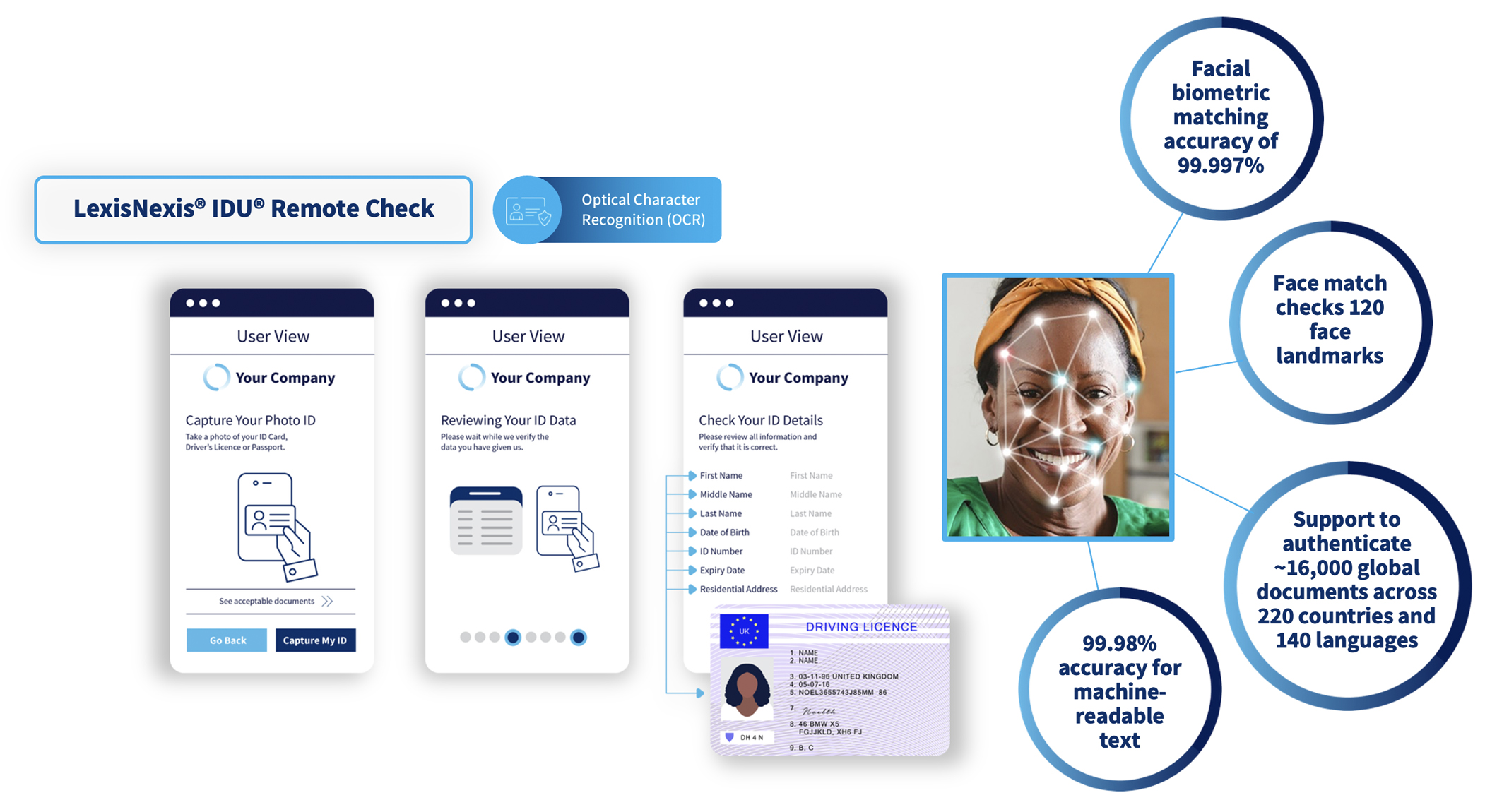

Document & Biometric Authentication

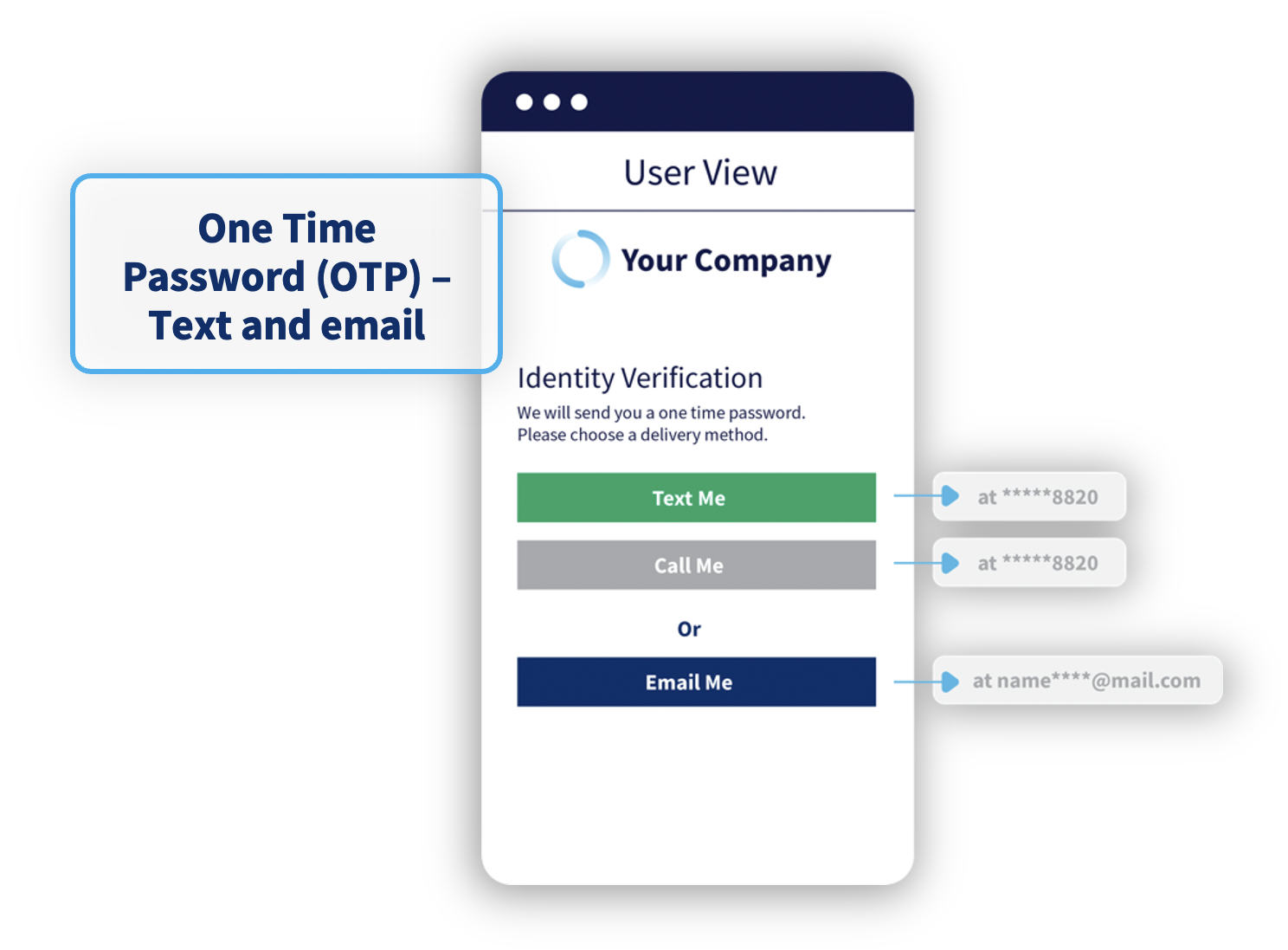

One Time Password Authentication

Risk Assessment

Flexible delivery options fit your requirements

Direct API

Platform

Portal

Batch

Add the advantages of IDU to your business

Accelerate customer conversion |

|

| |

Meet regulatory obligations |

Reduce financial and reputational loss due to fraud |

|

| |

Drive operational efficiencies |

Why choose identity verification from LexisNexis Risk Solutions?

Streamlining KYC and AML processes

“IDU provides us with an ability to electronically verify customer’s identities and addresses at the onboarding stage. Importantly, it also provides us with the ability to electronically identify any changes, which reduces the likelihood of losing touch with our customers.”

Merlyn Thomas, Head of Risk and Compliance

Reliance Bank

95% pass first time

“We now have a 95% first-time pass rate, and that is testament to the quality of data. Using IDU has helped to reduce the number of man hours spent on KYC by two to three hours.”

Abbas Kanani, Director and Pharmacist

Chemist Click

97% pass first time

“When people failed their identity checks, we would get customers cancelling their orders. However, IDU helps us pass customers the first time, which has decreased admin, improved customer satisfaction and increased revenue. It has definitely given us a competitive advantage.”

Andy Boysan, Founder & Pharmacist

The Independent Pharmacy

We’re recognised by leading global analysts for identity verification and fraud prevention

Insights Fraud Impact Awards 2024

Ranked #1 and the Established Leader in Juniper Research Competitor Leaderboard Digital Identity & Verification in the UK 2025

#1 Leader in Overall Leadership Compass and a Leader across - Product Leadership, Innovation Leadership, and Market Leadership within KuppingerCole Leadership Compass Fraud Reduction Intelligence Platforms (FRIP) Finance 2025 Report

Compliance 50 rankings 2025

“This distinction highlights the company’s steadfast commitment to providing innovative and reliable identity verification solutions tailored to the complex UK market."

LexisNexis, LexID and the Knowledge Burst logo are registered trademarks of RELX Inc. IDU is a registered trademark of Tracesmart Ltd. Other products and services may be trademarks or registered trademarks of their respective companies.

LexisNexis Risk Solutions UK Limited is registered in England & Wales. Registration number 07416642. LexisNexis® Risk Solutions is a trading name of Tracesmart Limited. Registered in England & Wales number 03827062. LexisNexis® Risk Solutions is a trading name of Crediva Limited, which is authorised and regulated by the Financial Conduct Authority under firm reference number 742498. England & Wales registration number 06567484. Tracesmart Limited and Crediva Limited are a part of LexisNexis Risk Solutions UK Limited. All are registered at Global Reach, Dunleavy Drive, Cardiff, CF11 0SN with VAT registration number GB730859520.

Copyright © 2025 LexisNexis Risk Solutions.