Fraudsters have finally met

their match.

Verify customer identities faster and smarter

Real Time Identity Verification: Access a 360 view of customer identity

Speed up trusted transactions with identity verification powered by physical and digital identity intelligence. Our patented LexID® and LexID® Digital linking technology covers 95% of the U.S. adult population, fueled by billions of digital and physical data points from leading consortium-driven networks.

Ensure applicant and customer information is reliable by super charging identity verification with unmatched data

Understand contextual identity characteristics and behaviours in every channel by harnessing a vast compilation of identity intelligence. Access robust identity coverage to enhance your KYC and CIP programs.

Make smarter customer acquisition decisions with layered identity verification solutions, more consumer information and AI-powered fraud detection.

Unmask synthetic identities, weed out bots and detect stolen identities with automated precision — all while providing a welcoming and hassle-free experience for legitimate customers.

Quickly verify identities and create multi-layered authentication approaches for greater fraud control and an improved customer experience.

Build comprehensive strategies or plug into your existing identity management framework:

-

Assessment that quickly matches identities to mobile devices, laptops and other digital devices -

Advanced analytics that yield perceptive insights for a more tailored approach to authentication

-

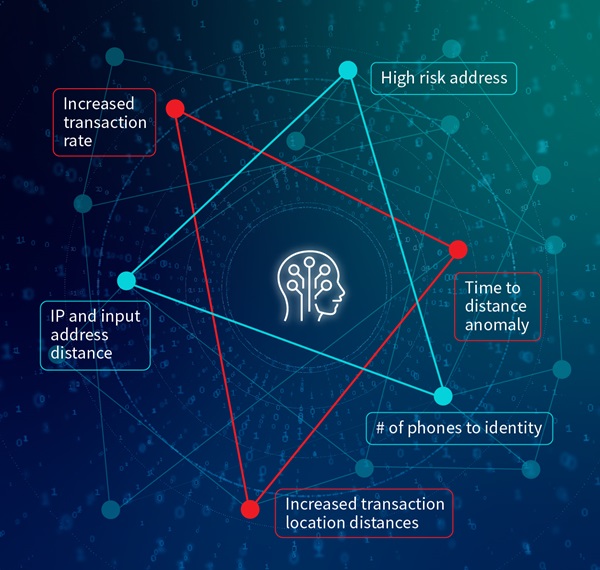

Real-time risk-based transaction scoring through digital identity intelligence

Multiply predictive identity trust by layering physical and digital insights

3.5x

Increased risk of fraud when there’s a difference between the applicant’s address and the most probable consumer address.

8.2x

Increased risk of fraud when an applicant’s email address is associated with three or more new devices within a 5-month window.

20x

Increased risk of fraud when an application presents both physical and digital intelligence risk signals at once.

Accurately verify identity at every customer touchpoint

Acquire more clients while preventing account opening fraud

Facilitate risk-appropriate experiences in login and account management

Authorise more transactions and protect from payment fraud

Safeguard customers from sophisticated authorised transfer scams

We provide leading identity verification solutions in over 200 territories, with expertise in multiple industries.

Financial Services

Establish identity trust and risk-assess indicators of identity fraud more accurately.

Ecommerce

Accelerate your customer acquisition process, reduce costs and mitigate risk.

Gaming and Gambling

Identify potentially high-risk data elements and get genuine customers playing without delay.

Telecommunications

Expedite customer onboarding while preventing bad actors from opening accounts with stolen credentials or synthetic identities.

Travel

Leverage deeper identity insight and prevent fraudsters from criminal activity.

Recognised around the world for award-winning technology

Make informed customer risk decisions quickly and confidently with robust identity verification solutions:

-

Gain trusted verification based on world-class physical and digital intelligence

-

Deliver a seamless customer experience

-

Mitigate the threat and cost of fraud

-

Increase customer approval rates without adding friction

-

Grow your business more securely

Frequently Asked Questions

Digital identity verification looks at the digital footprint associated with an individual’s identity and is commonly used for evaluating the risk associated with online transactions.

Physical identity verification considers personal information and government-issued documents to verify an identity.

Verifying a customer’s identity is the number one fraud challenge organisations face. This is centred around a few main areas of concern: increase use of the mobile channel, rise of synthetic identities and bot attacks, and a need to balance speed of fraud detection with customer friction.

Multi-layered identity verification solutions help mitigate these concerns and more; in turn protecting your revenue, your customer experience and your reputation.

Identity verification software helps to verify customers and impart a complete view of their fraud risk with physical and digital identity information.

This view enables you to conveniently onboard your customers by requesting only the necessary information at the right time by utilising active and passive methods.

Contact Us to Learn How We Can Help You

We believe in the power of data and analytics

to manage risk & uncover opportunity.

improving operational efficiencies and enhancing profitability.

This document is for informational purposes only and does not guarantee the functionality or features of any LexisNexis Risk Solutions products identified.

LexisNexis Risk Solutions does not represent nor warrant that this document is complete or error free. LexisNexis, LexID and the Knowledge Burst logo

are registered trademarks of RELX Inc. InstantID, ID Analytics, FraudPoint, Accuity and Emailage are registered trademarks of LexisNexis Risk Solutions

FL Inc. ThreatMetrix, Digital Identity Network, and ThreatMetrix SmartID are registered trademarks of ThreatMetrix, Inc. Other products or services

may be trademarks or registered trademarks of their respective companies.

Copyright © 2024 LexisNexis Risk Solutions